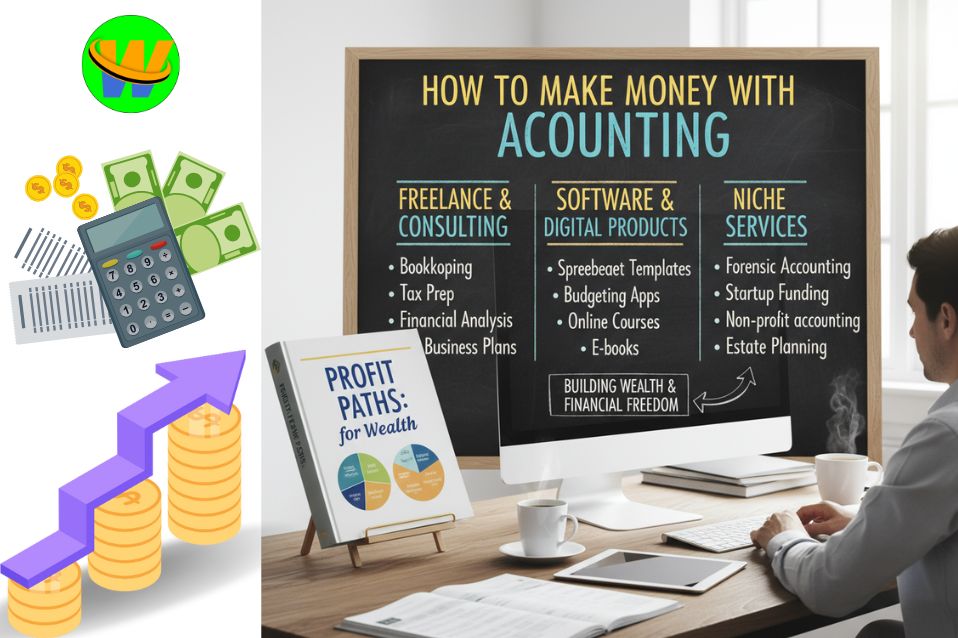

How to Make Money with Accounting

Accounting might sound like a dry profession full of numbers, spreadsheets, and financial statements—but if you look closely, it’s one of the most profitable and stable career fields out there. Whether you’re a student who loves math, a graduate looking for job opportunities, or even someone considering freelancing from home, accounting can open countless doors to earning money.

In this article, you’ll learn practical, realistic, and smart ways to make money with accounting—from traditional office jobs to modern online opportunities.

1. Become a Professional Accountant

The most straightforward way to make money with accounting is to become a professional accountant. Companies of all sizes need accountants to handle their finances, tax filings, and reports.

Here’s how to get started:

- Get Qualified: A degree in accounting, finance, or business is usually required. You can also pursue professional certifications like CPA (Certified Public Accountant), ACCA, or CMA to increase your value.

- Build Experience: Start as a junior accountant, bookkeeper, or assistant. Over time, you can move up to senior roles, financial manager, or even chief financial officer (CFO).

- Expected Earnings: An experienced accountant can earn anywhere from $30,000 to over $120,000 a year, depending on their experience and where they work.

The best part? Accounting is always in demand. Every company—from a small startup to a global corporation—needs financial experts.

2. Offer Freelance Accounting Services

If you don’t want to work 9 to 5, freelance accounting is a fantastic way to earn money independently. Many small businesses and entrepreneurs don’t have the budget to hire a full-time accountant, so they outsource their work to freelancers.

You can offer services like:

- Bookkeeping

- Tax filing and preparation

- Payroll management

- Financial analysis

- Budget planning

Where to Find Clients

You can start on platforms like:

- Upwork

- Fiverr

- Freelancer

- Toptal

Start by offering simple bookkeeping or tax help at a competitive rate. Once you gain positive reviews, you can increase your rates.

Example:

You may work from home and set your own hours for $2,000 a month if you can attract just ten clients to pay $200 each for bookkeeping.

3. Start a Small Accounting Firm

If you’ve gained enough experience, you can start your own accounting or consultancy firm. Many successful accountants start small—maybe from home or a small office—and build a loyal client base.

Here’s how you can begin:

- Register your business officially.

- Offer essential services like bookkeeping, payroll, and tax filing.

- Promote your services through social media, Google Business, and local advertising.

- Provide excellent customer service to encourage referrals.

Once your business grows, you can hire junior accountants, assistants, or interns to help you scale up. A well-established accounting firm can generate steady monthly income and long-term client relationships.

4. Teach Accounting or Become a Tutor

If you’re good at explaining accounting concepts, teaching can be both rewarding and profitable.

Options to Teach:

- Offer private tutoring to students studying accounting or business.

- Use resources like Teachable, Skillshare, or Udemy to teach online classes.

- Create a YouTube channel and share tutorials on topics like bookkeeping, financial analysis, or Excel for accounting.

Online learning is booming—and many people are searching for easy explanations of accounting concepts. If you record a course once and upload it online, it can earn passive income for years as more students enroll.

Example:

According to its popularity, a highly rated accounting course on Udemy can generate hundreds or even thousands of dollars per month.

4. Teach Accounting or Become a Tutor

Tax season is stressful for many people and businesses. This creates a great opportunity for accountants to earn extra income by becoming tax consultants.

You can help individuals and companies:

- File their tax returns accurately

- Plan their taxes efficiently

- Understand government tax laws

- Avoid penalties and overpayments

If you get certified and gain experience, you can charge per client or per return. During tax season, this can turn into a high-income period.

Tip: Market your tax services before the season starts—people will gladly pay for peace of mind when dealing with complex tax forms.

5. Become a Tax Consultant

Tax season is stressful for many people and businesses. This creates a great opportunity for accountants to earn extra income by becoming tax consultants.

You can help individuals and companies:

- File their tax returns accurately

- Plan their taxes efficiently

- Understand government tax laws

- Avoid penalties and overpayments

If you get certified and gain experience, you can charge per client or per return. During tax season, this can turn into a high-income period.

Tip: Market your tax services before the season starts—people will gladly pay for peace of mind when dealing with complex tax forms.

6. Work as a Forensic Accountant

If you enjoy detective-like work, forensic accounting might be for you. Forensic accountants investigate financial fraud, embezzlement, and money laundering. They often work with law enforcement agencies, auditors, and lawyers.

This field requires deep financial knowledge and attention to detail—but it’s also one of the most respected and high-paying accounting roles.

Forensic accountants can earn anywhere from $70,000 to $150,000+ annually, depending on experience.

7. Become an Accounting Content Creator

Social media isn’t just for influencers—accountants can build an audience too!

You can make money by:

- Sharing financial tips and business advice on TikTok, Instagram, or YouTube.

- Writing blogs about accounting, finance, and small business.

- Creating guides or eBooks about bookkeeping or financial planning.

As your audience grows, you can make money by:

- Ad revenue

- Sponsorships

- Selling digital products or courses

- Affiliate marketing (promoting accounting tools or software)

People love clear, simple financial advice—especially from professionals. If you can simplify complex topics, you can attract thousands of followers and multiple income streams.

8. Become a Financial Advisor

Accounting skills naturally lead into financial advising. Once you understand financial management and tax planning, you can help others make better money decisions.

You can work with:

- Individuals (helping them save, invest, and plan budgets)

- Small businesses (helping them manage cash flow, taxes, and expenses)

Financial advisors can charge hourly, per project, or earn commissions on investment products.

It’s a great way to use your accounting knowledge for long-term client relationships.

9. Develop or Sell Accounting Software and Templates

If you have tech skills alongside accounting knowledge, you can make money by:

- Developing simple accounting tools (Excel templates, budgeting sheets, etc.)

- Selling ready-made bookkeeping templates

- Creating software tutorials or automations for QuickBooks, Xero, or Excel

For example:

- Sell Excel accounting templates on Etsy or Gumroad.

- Build and sell financial dashboards using Google Sheets.

- Offer custom automation services for small business clients.

These small products might sell for $10–$100 each, but over time they can create steady passive income.

10. Remote Accounting Jobs

With the rise of remote work, you don’t even have to be in an office to earn money with accounting skills.

You can find remote jobs such as:

- Virtual bookkeeper

- Payroll specialist

- Tax preparer

- Accounting assistant

Remote jobs often pay nearly the same as in-office roles, but you save time and costs on commuting.

Websites like Remote.co, We Work Remotely, and FlexJobs list such positions regularly.

11. Offer Accounting Services to Startups

Startups often need help managing their finances but can’t afford full-time accountants. You can offer part-time or on-demand accounting services to them.

Help them:

- Track their expenses

- Prepare financial statements

- Set up their accounting systems

- Forecast budgets and growth

By positioning yourself as a financial partner for startups, you can build long-term contracts and become part of their growth journey.

Final Thoughts: Turning Numbers into Income

Accounting isn’t just about crunching numbers—it’s about understanding money, structure, and opportunity. Once you master these skills, you can earn in countless ways—whether as a professional accountant, freelancer, teacher, consultant, or creator.

Here’s the truth:

Money flows to those who manage it well—and accountants do exactly that.

So, if you’re good with numbers, detail-oriented, and enjoy problem-solving, start today. Learn the tools, offer your skills, and market yourself online or locally. With patience and dedication, you’ll find that accounting is one of the most reliable and rewarding ways to make money—both online and offline.